Shark Tank is an American Business Reality Show. Shark Tank India is the Indian franchise of this show. The show is aired on Sony Entertainment Television and online on SonyLIV.

“Sharks” are the panel of Investors of this show. They hear about the product or business of several budding Entrepreneurs and invest in their business. The show has become very popular in a very short time. The show is interesting and fun to watch but there are a few terms that are giving the audience a hard time.

Photo Credit: bollyzone

So, we are going to list some of the most used terms in the show and what they mean:

1. Equity

The amount of capital invested or owned by the owner of a company is referred to as Equity. The difference between an organization’s liabilities and assets on its balance sheet is used to determine equity. If all the debts were paid off and all the assets were liquidated the value restored to a company’s shareholders is referred to as equity. A present share price or a value regulated by investors helps in determining the equity. There are generally two types of equity value: the Book Value and the Market value.

Example: If a Company, ABC had one lakh outstanding shares, and if its current market value is ₹100 per share. The company’s market value of equity will be {₹100 per share X 1 lakh outstanding share = 100 lakhs}

Photo Credit: business-standard

2. Revenue

The value of all goods and services sold by a firm in a given period is referred to as revenue. The income statement shows how much money you have gained. Revenue and profit are not the same. The cost of producing revenue should be less than the revenue generated from sales, to make a profit.

Example: If a company sells ₹60,000 worth of products in December but allows the customer to pay 30 days later, the company’s revenue for December is ₹60,000, even though it hasn’t received cash in December.

Photo Credit: dtechy

3. EBITDA

EBITDA, earnings before interest, taxes, depreciation, and amortization. It indicates the financial performance that can be used in place of net income in some situations. In a nutshell, EBITDA is a productivity measure. Many individuals use EBITDA to assess the worth of a company because it focuses on the financial consequence of operations. It also demonstrates the strength of a company’s operating budget apart from its assets.

The formula for calculating EBITDA is:

Net income + interest expense + taxes + depreciation + amortization = EBITDA

Example:

Suppose XYZ Company wants to know its EBITDA. They will first look at their income statement. EBITDA is the summation of net income, interest expenses, taxes, depreciation, and amortization. Numbers on their income statement:

-

Net income: $500,700

-

Interest expenses: $10,000

-

Taxes: $1,000

-

Depreciation: $10,000

-

Amortization: $5,000

The sum, or EBITDA, of these items, is $531,700.

Photo Credit: ionos

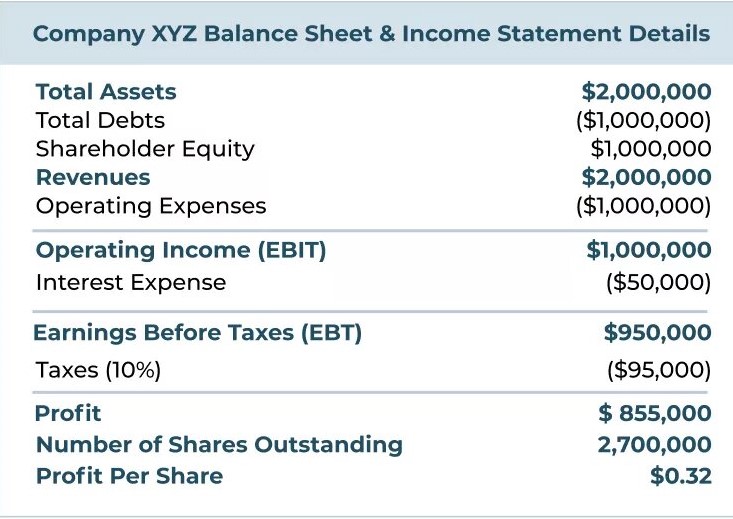

4. Profit

Profit, or net income, is the difference between the gains and expenses for a given period. When the money generated from a business activity exceeds the expenses, costs, and taxes involved in maintaining the activity, profit is earned. Entire revenue is subtracted from total expenditure to determine profit. There are different types of profit: net, gross, and operational profit.

Profit = Total Sales – Total Expenses

Photo Credit: investinganswers.com

We can calculate that Company XYZ’s profit by using the profit formula:

$855,000

5. ROI (Return on Investment)

Return on investment (ROI) is financial data represented as a percentage and it is used to determine the profitability of an investment in relation to its costs. Its purpose is to directly evaluate the amount of profit made on a given investment in relation to its cost.

Example:

Suppose an investor purchases property A, which is valued at $1,000,000. If the investor sells the property for $2,000,000 two years later. By using the investment gain formula, we get ROI = (2,000,000 – 1,000,000) / (1,000,000) = 1 or 100%

6. SKU (Stock Keeping Unit)

A unique number or code is used to identify each product stocked in a retail outlet for tracking and inventory purposes is referred to as Stock Keeping Unit. It plays a big role in stock maintenance and record-keeping. This increases productivity and efficiency.

Photo Credit: primaseller

How is SKU useful?

- SKU helps in differentiating the size of the same products, this will help you understand better that size L is different from size M.

- The code will ensure that you are aware of your stock amount.

- It helps in stock reconciliation, it helps in understanding the stock is low or sufficient.

- It also helps in reordering a particular product.

If you are selling a black Nike shoe of shoulder size 6, then a good SKU code for this can be NK-SH-06-BK

NK – represents that the brand is Nike, SH – represents shoe, 06 – shoe size, BK – represents the color black.

7. QSR (Quick Service Restaurant)

Restaurants that sell foods that require very little time in preparation and can be delivered quickly. They generally cater to fast food items and have a limited menu. These restaurants are known to have modular, standardized, and efficient processes which help in reducing the lead times and fulfilling the orders while maintaining the quality as per customer expectations.

For example, Domino’s, Burger King, McDonald’s, Starbucks, etc.

This information about the business terms and phrases will help you in exploring the financial world and launching your firm. We hope you liked this article.

Photo Credit: qsrmagazine