A personal loan is the most sensible and convenient option to meet sudden expenditures. Since personal loans are unsecured, the borrower need not worry about having an asset like a property or gold to pledge against it. It makes getting a personal loan comparatively easier than other loans.

Lenders further ease the personal loan process for customers by offering online personal loans. All this has made personal loans grow 2.3 times in terms of value and 3.8 times in terms of volume in the last four years between 2017 and 2021. Personal loans appeal to borrowers for their comparative ease of approval and the fact that the loan amount can be spent as per the requirement of the individual.

Ten Basic Rules to Get the Best Deal on a Personal Loan Online

A slight difference in interest rates can affect the overall cost of the loan drastically. Easy documentation and eligibility criteria can make the loan approval process faster. Fullerton India Personal Loan online is the preferred option among the various online lenders offering a personal loan due to reasonable interest rates and transparent processes.

You can follow a few basic rules to get the best deal on a personal loan online.

1. Choose the Right Lender

A common mistake first-time borrowers make is applying with too many lenders at one time for a loan. It can negatively affect their credit score and reduce their chances of availing of credit in the future. The correct approach is to visit the website of different lenders and carefully assess their lending terms and loan offers. Apply only with the lender you find suitable for taking the loan.

Fullerton India provides instant online personal loans with minimal paperwork and easy processes.

Photo Credit: fortuneindia

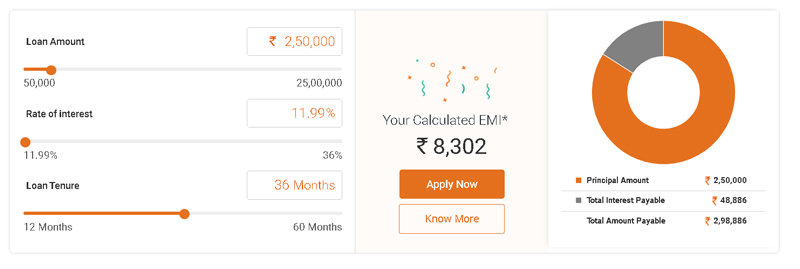

2. Calculate the Applicable Interest Rate

The interest rate decides the loan’s cost for the borrower. Borrowers can use the personal loan EMI calculator to calculate the amount they would have to pay every month as instalments.

Photo Credit: Fullerton India

Personal loans start at only 11.99% per annum at Fullerton India for salaried and self-employed applicants.

3. Maintain a Healthy Credit Score

Lenders check the customer’s credit score and credit history before approving his loan. Credit score and credit history become even more important for unsecured loans like personal loans since the lender does not have the option to sell off the asset kept as collateral to recover the debt.

A healthy credit score between 750 and 900 assures the lender of the capacity and willingness of the borrower to pay the loan. A good past repayment history is an assurance that the borrower is disciplined with loan repayments, thereby making them low-risk applicants and increasing their chances of loan approval.

4. Shorter Tenure Loans

The loan tenure also affects the cost of the loan. A longer tenure loan means smaller monthly installments, but it increases the loan’s overall cost. A borrower should opt for a shorter-duration loan with higher monthly installments to pay off the loan early and reduce the cost of the loan. Use a personal loan EMI Calculator to select the optimal tenure for your personal loan so that the resulting EMI does not strain your finances and at the same time, you will be able to repay the loan quickly.

Photo Credit: adityabirlacapital

5. Avoid Advance EMIs

Advance EMIs increase the cost of the loan for the borrower. Sometimes, lenders ask for a couple of EMIs as an advance while approving the loan. It makes the borrower pay more than he should. Therefore, opt for a lender who asks for regular EMIs and not advance EMIs. Fullerton India offers personal loans through a 100% transparent and reliable loan approval process.

6. Be Disciplined with Repayments

A borrower who pays his EMIs regularly without a default can improve his credit score remarkably. It can be beneficial if the individual wants to take credit ever in the future. Timely EMI payments also eliminate any chance of a penalty from the lender.

7. Ensure zero Hidden Charges

There can be hidden or affiliated charges with a personal loan. It is crucial to ensure that the lender does not levy such hidden charges beyond the disclosed charges at loan disbursal. Fullerton India personal loans come with zero hidden charges for borrowers.

8. Foreclosure Charges

If a borrower wants to repay the remaining loan before the end of the loan tenure, the lender levies foreclosure charges on the loan amount. Look for a lender with minimum foreclosure charges to bring down the cost of the loan. Fullerton India charges between 0% to 7% as foreclosure charges.

9. Avoid the 0% EMI Schemes

Some lenders offer 0% EMI schemes to borrowers. However, these loans have a high processing fee and other charges that are not disclosed to the borrower in full. Therefore, it is advisable to avoid such schemes and look for a borrower with a low-interest rate and convenient repayment terms.

10. Look for Quick Disbursals

Usually, people take a personal loan when they need emergency funds. Thus, the loan processing and disbursal time are crucial to the borrower. Look for a borrower with fast loan processing and disbursal of the loan amount.

Photo Credit: BadCredit

Fullerton India credits the bank account of the customer with the loan amount within 30 minutes* of loan approval. The low-interest rates, quick disbursals, and transparent processes make Fullerton India the best platform to get online personal loans.